Most growing companies hit the same wall: Their spreadsheet-based reporting systems can't keep up with their success. You started simple—maybe one Excel file with basic financials. But as you added new markets, systems, and legal entities, your reporting became a house of cards.

The warning signs include:

| Problem | Impact |

|---|---|

| ⏰ Manual data consolidation | Taking 10+ hours monthly |

| ❌ Error rates above 20% | Unreliable financial reports |

| 🐌 Delayed decision-making | Missed market opportunities |

| 🔀 Multiple versions of truth | Confusion and mistrust |

| 💱 Currency conversion nightmares | Errors and unreconcilable numbers |

Before building solutions, you need to understand what you're working with. Create a comprehensive inventory:

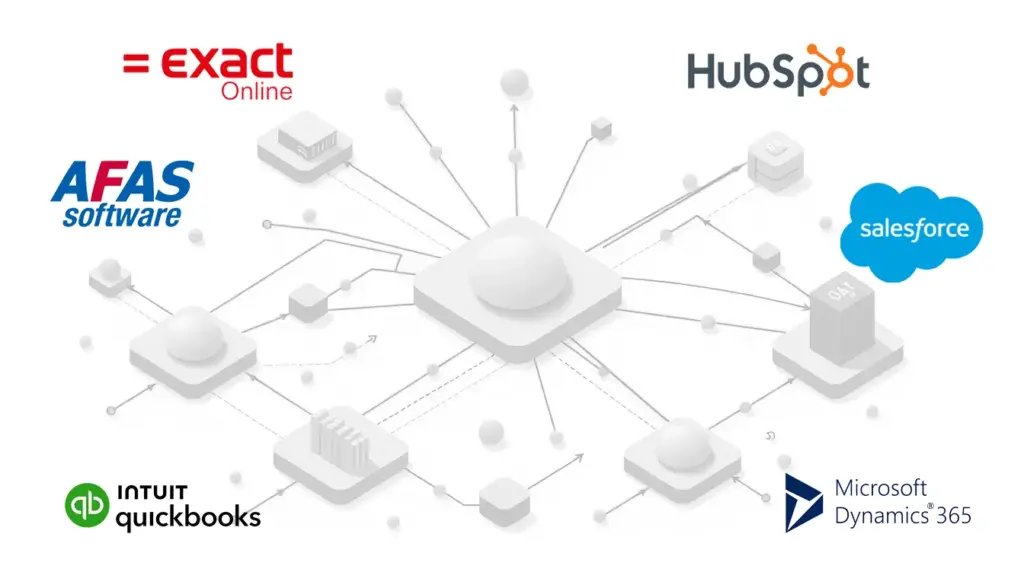

Map every data source by creating a comprehensive inventory of where your critical business information lives. Start with your financial systems like Exact Online, QuickBooks, or SAP, then expand to include CRM platforms such as Salesforce, HubSpot, or Pipedrive. Don't forget operational tools including HR systems and project management platforms, plus external data feeds like currency rates and market data that impact your reporting.

Document the pain points that are costing your business time and accuracy. Calculate exactly how many hours your team spends on manual reporting each month, identify where errors typically occur in your current process, and note which critical decisions get delayed because you're waiting for reliable data. Most importantly, list the business questions you can't answer quickly—these gaps often reveal your biggest opportunities for improvement.

Assess data quality across all your systems to understand what you're working with. Determine how current your most important data actually is, map out where the gaps and inconsistencies exist between systems, and identify which datasets need the most cleanup before they can be trusted for automated reporting. This assessment will guide your integration priorities and help you avoid building dashboards on unreliable foundations.

The key insight: don't replace systems that work—connect them.

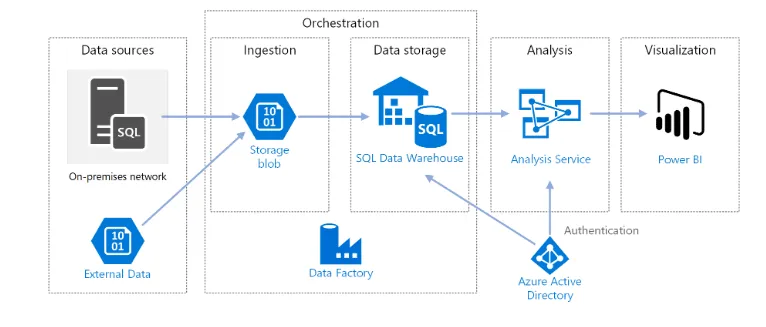

Choose your visualization platform: PowerBI works exceptionally well for businesses already in the Microsoft ecosystem. It integrates seamlessly with Excel workflows while providing enterprise-grade analytics capabilities.

Plan your data pipeline:

Design for daily refreshes: Business moves fast. Design your pipeline to update at least once daily, preferably during off-hours to ensure fresh data each morning.

For multi-entity businesses, this is where most projects get stuck. Here's how we approach it:

Create a master chart of accounts that serves as the foundation for all your consolidated reporting. This involves mapping each legal entity's GL accounts to standardized categories that make sense across your entire organization, establishing consistent naming conventions that eliminate confusion between markets, and handling currency conversions at the data level rather than in your final reports. Most critically, document all mapping rules thoroughly—future audits and system changes will thank you for this detailed documentation.

Build transformation logic that automates the complex business rules your accountants currently handle manually. Set up automated account code conversions so data from different entities flows into the right buckets, implement multi-currency consolidation that applies real-time exchange rates consistently, and configure elimination entries for inter-company transactions to avoid double-counting revenue or expenses. Always validate that your transformed totals match the source systems—this reconciliation step catches integration errors before they reach your executives.

Pro tip: This step often takes longer than expected. Budget 2-3 weeks for complex multi-entity mapping.

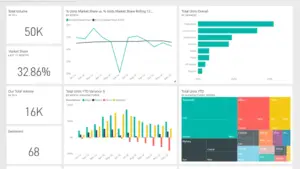

Start with the executive overview that answers these five questions instantly:

Design principles:

Exact Online integration specifics:

Establish refresh schedules:

Build monitoring systems:

Data accuracy verification:

User acceptance testing:

When implemented correctly, this approach delivers measurable improvements:

Operational efficiency:

Strategic advantages:

Technical achievements:

This isn't a weekend project. Here's what makes it complex:

Integration challenges:

Ongoing maintenance:

Skills required:

While the framework above gives you the roadmap, the execution requires expertise across multiple disciplines. Consider professional help if:

The difference between a successful implementation and a failed project often comes down to experience with the inevitable edge cases and integration challenges that every business faces.

Start with Step 1—the data audit. Spend one week documenting your current state. You'll quickly see whether this is a project you can tackle internally or if you need specialized expertise.

Most businesses discover that while the concept is straightforward, the execution requires more technical depth than initially expected. That's not a failure—it's just the reality of modern data integration.

The question isn't whether you need better data insights (you do). The question is whether you'll build this capability internally or partner with experts who've solved these challenges dozens of times before.

Either way, the cost of staying in spreadsheet chaos—missed opportunities, delayed decisions, and embarrassing errors—far exceeds the investment in proper business intelligence infrastructure.

Ready to transform your data chaos into automated insights? We've guided dozens of scaling companies through this exact transformation. The framework above gives you the roadmap, but if you want expert implementation that gets results in weeks instead of months, let's talk.